- Office No.– G22, Second Floor, Sector 3, Noida, Uttar Pradesh 201301

- 01204535507, +91-7011962266

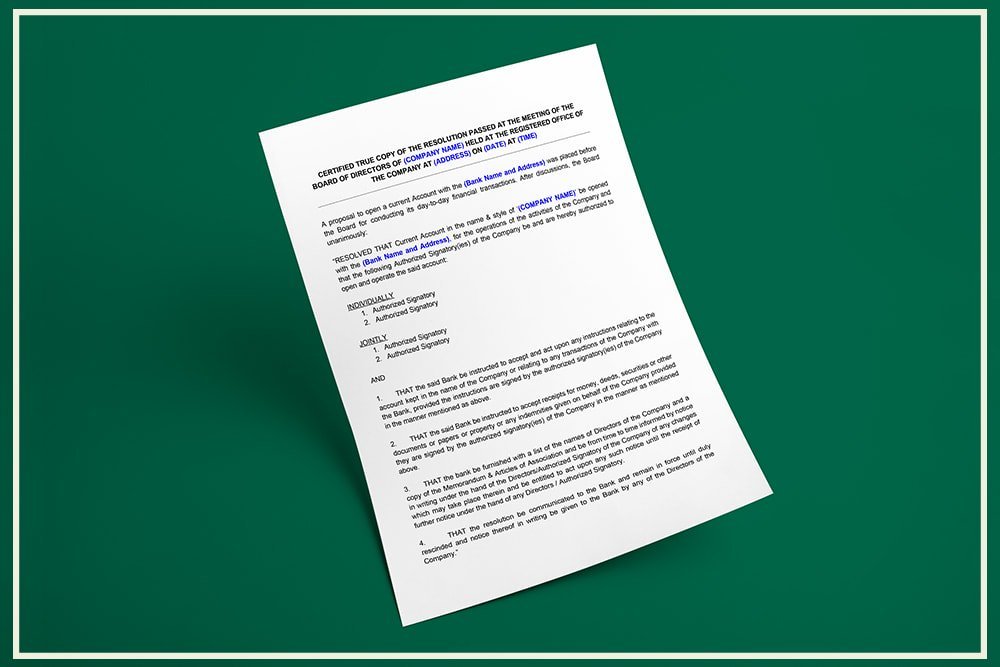

Board Resolution for Opening Bank Account

Main objectives of Board Resolution for Opening Bank Account

The main objectives of a Board Resolution for opening a bank account are to formalize and document the decision-making process within a company or organization regarding the establishment of a new bank account. This resolution, typically passed by the board of directors or authorized officers, serves to authorize specific individuals to act on behalf of the company in matters related to the new account. The resolution outlines key details such as the purpose of the bank account, the authorized signatories who have the power to transact on the account, and any specific restrictions or conditions related to the account operations. Moreover, the Board Resolution for opening a bank account ensures compliance with internal governance policies and legal regulations. It acts as an official endorsement of the decision, providing clarity and legitimacy to the bank and any external parties involved. Additionally, the resolution may include provisions for the submission of necessary documents to the bank and any other procedural requirements, thus streamlining the process of establishing the new bank account in a transparent and accountable manner.

We are Always Ready to Assist Our Clients

The Advantages of Board Resolution for Opening Bank Account

The issuance of a Board Resolution for opening a bank account offers several advantages for a company or organization. Here are the key benefits:

Authorization and Clarity:

- The resolution provides explicit authorization from the board of directors or authorized officers to open a new bank account. This clarity ensures that the designated individuals have the legal authority to act on behalf of the company in financial matters.

Compliance with Internal Policies:

- The Board Resolution ensures compliance with the company’s internal policies and procedures. It demonstrates that the decision to open a new bank account aligns with the established governance structure and guidelines set by the organization.

Legal Recognition:

- The resolution serves as a legally recognized document, providing evidence that the decision to open a bank account has been duly authorized by the governing body of the company. This can be crucial for legal and regulatory compliance.

Designation of Authorized Signatories:

- The resolution designates specific individuals as authorized signatories for the new bank account. This ensures that only authorized personnel have the power to conduct transactions and manage the account on behalf of the company.

Protection Against Unauthorized Actions:

- By explicitly naming authorized signatories, the resolution helps protect the company from unauthorized actions. It reduces the risk of fraud or misuse of the company’s funds by ensuring that only designated individuals have access to the bank account.

Process of Board Resolution for Opening Bank Account

The process of issuing a Board Resolution for opening a bank account involves several key steps. Here is a general outline of the process:

Proposal and Justification:

- A proposal to open a new bank account is presented to the board of directors or authorized officers. The proposal typically includes the purpose of the account, the need for its establishment, and any relevant details about the intended operations.

Discussion and Approval:

- The proposal is discussed during a board meeting or a meeting of authorized officers. After thorough deliberation, the board members or officers vote to approve the opening of the new bank account. The decision is recorded in the meeting minutes.

Appointment of Signatories:

- The board identifies and appoints specific individuals who will be authorized signatories for the new bank account. These individuals are typically key executives or officers responsible for financial transactions.

Drafting the Board Resolution:

- Based on the approved proposal and decisions made during the meeting, a Board Resolution is drafted. The resolution includes details such as the purpose of the bank account, the authorized signatories, any limitations or conditions, and the approval of the board.

Review by Legal Counsel (Optional):

- In some cases, the drafted resolution may be reviewed by the company’s legal counsel to ensure that it complies with relevant laws and regulations. This step is especially important if the company operates in multiple jurisdictions.

Get in Touch

Please, fulfill the form to get a consultation. After processing the data, a personal manager will contact you.